Disclaimer: The views expressed represent Giancarlo Lamourtte’s opinions. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment.

New American Dream: A Tenant’s Paradise

Is the American Dream dead? If it includes buying a home, the answer in recent years has been a resounding, yes. But we’re seeing some trends pointing to a slowdown, as young potential homebuyers wait on the sidelines in anticipation. It’s strange to hope for a certain market to break, but an economy is a complex machine composed of consumers, producers, labor, resources, sentiment, regulation, etc., etc. A healthy economy requires all parts to run at the right pace, not too hot, not too cold. At the moment, we have three segments of the economy running too hot: housing, inflation, and labor.

Don’t Touch My Dukedom

Housing went into exponential growth mode over the last two years. The following graph color coordinates the percentage of new home sales by price range. Homes for less than $300,000 are colored in red and totaled 80% of new home sales in 2002. The figure gradually declined to 40% a few months before the pandemic, and now — in 2022 — only 10% of new homes are being sold for less than $300,000.

Household incomes haven’t kept up with appreciation. A good indicator to gauge home affordability is the US Housing Affordability Index which measures whether a typical family can earn enough income to qualify for a mortgage on a typical home. According to the index, affordability hasn’t been this low since June 1989.

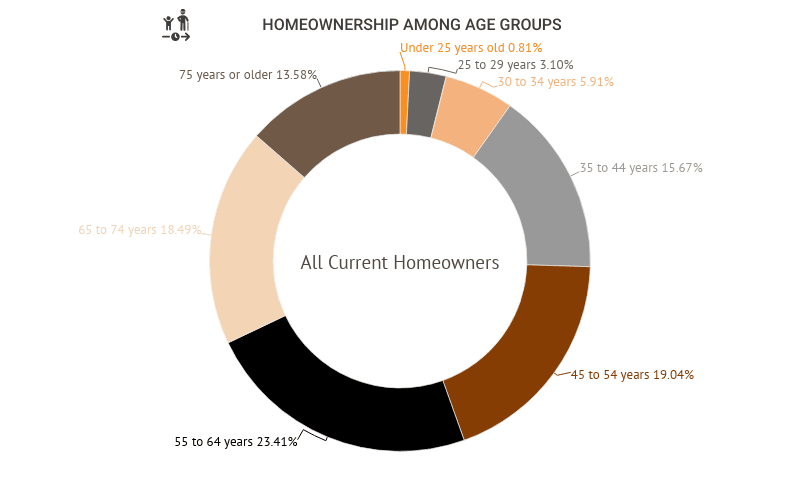

This has continued to frustrate young homebuyers, as those under 35 years old make up less than 10% of homeownership.

Many from this 10% can only achieve ownership through inheritance or financial assistance from family. This exacerbates the severity of income inequality as the average net worth of a homeowner is over $1.1 million vs. $95,600 for those who don’t own a home. Fast forward a few decades with this issue left unattended and we’ll be a quasi-feudal system where land ownership is determined by family lineage.

Fortunately, there’s a lot of attention on the subject and we’ve diagnosed the problem. It comes down to a fiercely disputed topic, how to grow the housing supply? The pandemic certainly hurt this effort as construction was halted and supplies were hard to come by, but this issue is rooted deeper and continues to plague urban areas. The battlefield of this debate takes place around zoning laws and conservation rules, and factions have been formed, YIMBYs vs. NIMBYs, which stand for, “yes in my backyard” or “not in my back yard,” referring to those who will — or will not — allow new development in their neighborhood or city. I’m not familiar with zoning laws or involved in the deeper discussions, but Noah Smith has written extensively on this topic and I highly recommend reading his work. This issue will take time to resolve and cities are taking different approaches. Time will tell what the right formula is. In the meantime, we may find some relief as it seems market forces will push down housing prices in the short to medium term.

My Way Home

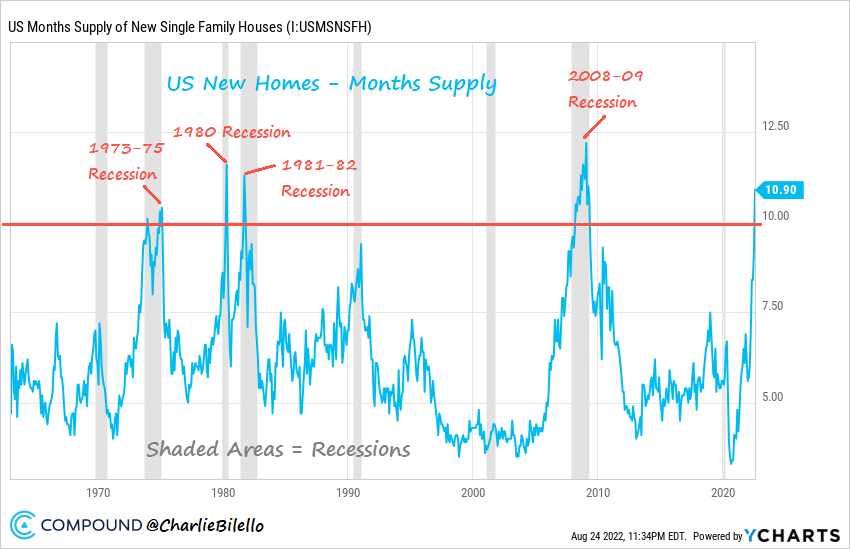

Real estate conditions are tightening. In my first post, I mentioned there were early signs we might see a rise in the supply of homes — which would put downward pressure on prices. It’s starting to materialize, and in August, we had the largest supply of new homes since June 2009.

Along with the increase in supply, demand for new and existing homes has dropped. New home sales hit a 6-year low and are down over 50% from their 2020 peak while existing home sales are down 20% over the last year.

These factors then flow down to the average price of a home. Roughly 8% of listings lowered their asking price and the median price of homes sold fell almost 6% from the all-time high in mid-June.

The reason we’re seeing easing prices in the housing market is multi-faceted:

The Fed’s continued policy to raise interest rates has caused mortgage rates to go up, making homeownership less affordable and pushing down demand.

Commodity prices related to home construction have gone down since the midst of the pandemic (e.g., the price of lumber).

It’s also a cyclical/sustainability thing. Every market has its cycles and individuals can bear price increases up to a certain point. Eventually, every buyer gets priced out of the market and sellers have to adjust.

Stocks, bonds, and most other assets went kaput earlier this year and left everyone asking, when real estate? Well, real estate tends to lag the rest of the market. It takes time for these factors to trickle down to the average person and it can take months to sell your home. Stocks and other financial securities take seconds to sell and you can’t live inside them. These factors may also impact the commercial real estate market as rising rates compress profit margins, not to mention the second-order effects of the work-from-home (”WFM”) model and businesses reconsidering office space as leases begin to expire.

Anyways, this seems to be a healthy step forward, and where the Fed would like things to go as they continue their trek toward slaying inflation. Next post we’ll cover the bigger picture.

What's Going On #5